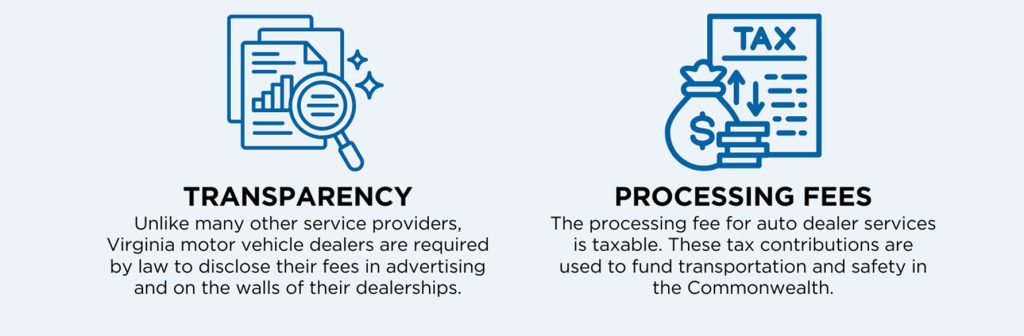

Processing fees remain one of the most asked-about — and sometimes misunderstood — parts of the vehicle transaction. To help, VADA has created a new suite of resources for you and your customers.

- A one-page information sheet you can download and share with staff or buyers.

- An updated website with answers to common questions and background information you can point consumers to.

Both are designed to help you explain the value of processing fees, the services they cover and the transparency requirements under Virginia law.

Download the free one-page PDF What are Processing Fees?